A common mistake made by security contracting businesses

Are you in complete control of your finances, or are you still guilty of ‘looking in the rearview mirror’ and hoping for the best? Bright Business Advice Founder & CEO, Emerson Patton, reveals where most Security Contracting businesses get it wrong - and the simple changes you can make to master your money.

Listen, none of us start a business because we love dealing with the finances. The accounting software. The invoices. Chasing payments. The spreadsheets. That’s what accountants are for, right?

Many of the contractors I work with are guilty of doing the same thing:

They spend all their time looking in the ‘rearview mirror’ instead of looking at the road ahead.

You see, most of us produce a P&L or management accounts that give us an idea of how the business performed in the last month. If you’re not producing this already, you need to start today!

While having a P&L is important, it only tells part of the story. The reason I say it’s like “looking at your rearview mirror” is because it only tells you what’s already happened.

And if you’re only looking backwards while you’re driving, it’s not going to be long before you crash…

That’s why it may not come as any surprise that 96% of the businesses that fail in the UK each year, fail because of CASH FLOW issues.

Same goes for ‘unexpected’ tax bills, late payments, and cancelled jobs.

Without looking out your front windscreen at the road ahead, it’s impossible to spot the potholes and problems before you get to them. Making it impossible to prepare.

Ideally, you want to have a 3-week rolling forecast in place. Month 1 is your ‘basic’ forecast - based on invoices you’ve sent, month 2 is your ‘intermediate’ forecast - based on work in progress, and month 3 is your ‘advanced’ forecast - which is harder to predict, and relies on your sales forecast.

The good news is, you don’t need to do all this yourself. With some half-decent accounting software like Xero, and a bookkeeper/accountant, producing these should only take a few hours each month - but will potentially save your business!

Remember - if you’re only producing a P&L annually, you’re only doing it for the tax man. Doing a monthly helps you spot trends and predict what might happen - helping you make better decisions and increase your profits.

Doing this will also help you close the cash gap.

If you combine this with more structure around your receivables - so invoices are sent on time, with clear terms, and chased relentlessly if paid late - you’ll massively improve your own cash flow.

My advice? Don’t be too tempted by invoice factoring.

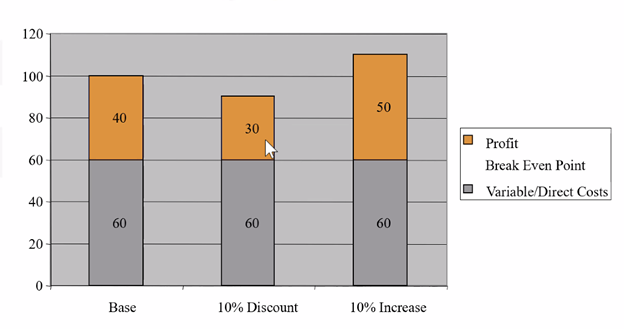

As you can see, giving a 10% discount actually reduces your profit by 25% - because you’re only giving away your margin!!

To receive 2 free videos on how you can master your business finances - without spending hours creating spreadsheets - using my A.S.S.E.T. model, download my Bright Business Toolkit today and claim your free 20-minute coaching call by visiting https://toolkit.brightbusinessadvice.co.uk/bsia